Demystifying the Credentials Refine for an Equity Funding Authorization

Navigating the qualification process for an equity funding approval can commonly appear like analyzing a complex challenge, with numerous elements at play that determine one's eligibility. Recognizing the interplay in between debt-to-income ratios, loan-to-value ratios, and other crucial standards is vital in protecting approval for an equity loan.

Trick Qualification Criteria

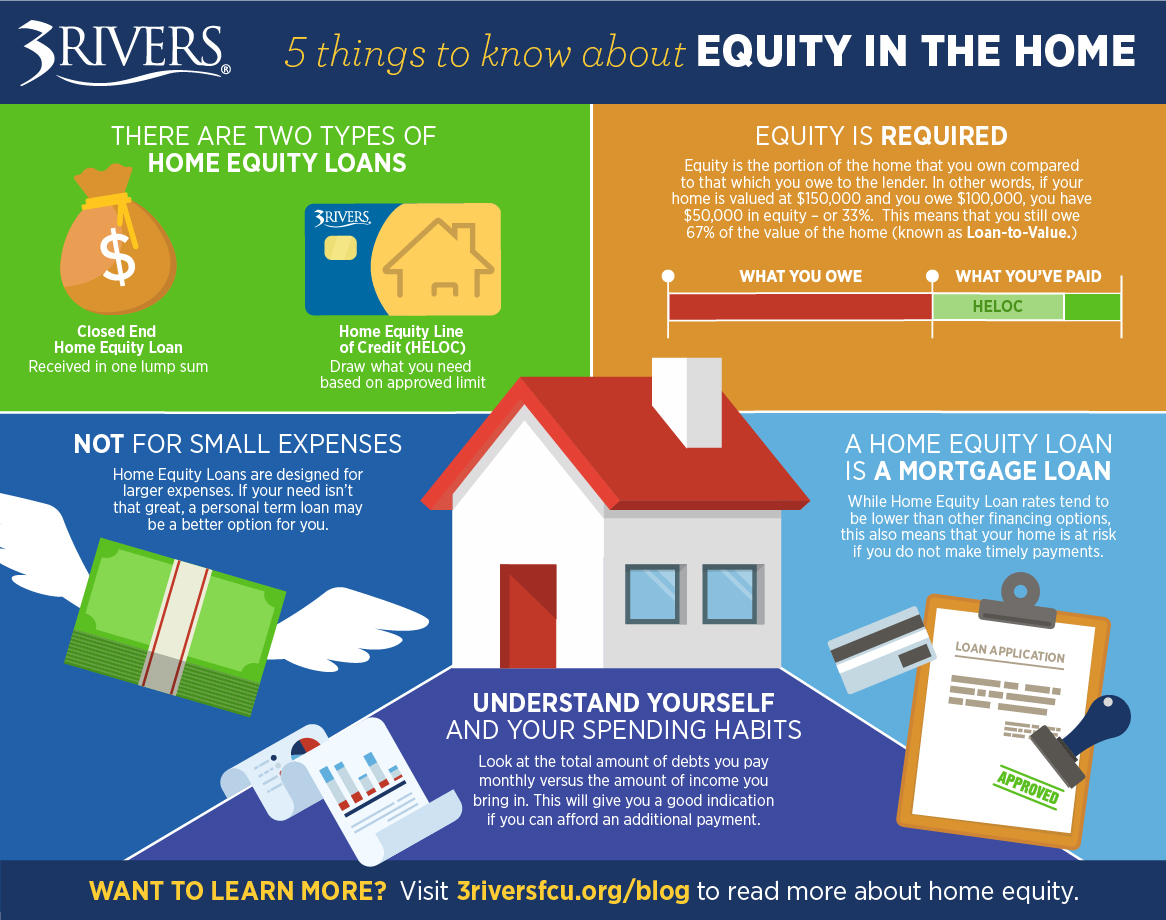

To get approved for an equity financing authorization, conference specific crucial qualification requirements is crucial. Lenders commonly need candidates to have a minimum credit history, typically in the series of 620 to 700, relying on the institution. A strong credit report history, revealing a liable payment record, is additionally crucial. Additionally, lenders analyze the candidate's debt-to-income proportion, with a lot of favoring a proportion listed below 43%. This demonstrates the consumer's capacity to manage extra financial obligation responsibly.

In addition, lenders review the loan-to-value ratio, which compares the quantity of the lending to the appraised worth of the home. Usually, lenders like a lower proportion, such as 80% or less, to alleviate their risk. Work and income security are essential elements in the approval procedure, with lenders looking for assurance that the customer has a trusted source of revenue to repay the finance. Meeting these vital qualification standards enhances the possibility of safeguarding authorization for an equity loan.

Credit Rating Value

Credit history typically range from 300 to 850, with higher scores being extra favorable. Lenders commonly have minimal credit rating demands for equity loans, with scores over 700 normally considered great. It's essential for candidates to assess their credit history reports routinely, looking for any type of errors that can adversely influence their scores. By maintaining an excellent credit history through prompt expense payments, reduced debt application, and liable loaning, applicants can boost their chances of equity financing authorization at competitive prices. Comprehending the relevance of credit rating and taking steps to enhance them can dramatically affect a consumer's monetary opportunities.

Debt-to-Income Proportion Evaluation

Provided the essential role of credit history in establishing equity funding approval, one more essential element that lenders examine is a candidate's debt-to-income proportion evaluation. The debt-to-income proportion is a vital monetary statistics that offers insight right into an individual's capacity to manage extra financial debt responsibly. Lenders compute this ratio by separating the total month-to-month financial debt responsibilities of an applicant by their gross regular monthly revenue. A reduced debt-to-income proportion indicates that a customer has more earnings available to cover their financial debt payments, making them a more eye-catching prospect for an equity funding.

Consumers with a higher debt-to-income ratio might encounter obstacles in securing authorization for an equity car loan, as it suggests a greater risk of failing on the loan. It is crucial for candidates to analyze and possibly lower their debt-to-income proportion prior to applying for an equity financing to enhance their chances of approval.

Residential Property Evaluation Needs

Examining the value of the property through an extensive appraisal is a basic action in the equity finance authorization procedure. Lenders need a residential property appraisal to make certain that the home gives sufficient collateral for the funding quantity requested by the consumer. During the building appraisal, a qualified appraiser examines various aspects such as the building's problem, dimension, location, comparable residential property worths in the area, and any distinct functions that might affect its total well worth.

The their explanation building's appraisal value plays a crucial role in establishing the optimum amount of equity that can be obtained versus the home. Lenders normally require that the appraised worth satisfies or exceeds a specific portion of the loan quantity, referred to as the loan-to-value proportion. This ratio aids alleviate the lender's danger by making sure that the property holds enough worth to cover the loan in case of default.

Eventually, a detailed residential property assessment is important for both the debtor and the lending institution to accurately assess the residential property's worth and identify the feasibility of granting an equity car loan. - Home Equity Loans

Recognizing Loan-to-Value Proportion

The loan-to-value ratio is a key economic metric used by lenders to assess the danger related to supplying an equity lending based on the residential property's appraised worth. This proportion is determined by separating the amount of the finance by the appraised value of the residential or commercial property. As an example, if a home is evaluated at $200,000 and the loan amount is $150,000, the loan-to-value proportion would certainly be 75% ($ 150,000/$ 200,000)

Lenders utilize the loan-to-value proportion to figure out the level of danger they are taking on by offering a loan. A higher loan-to-value ratio shows a higher risk for the loan provider, as the customer has much less equity in the property. Lenders commonly favor lower loan-to-value ratios, as they supply a cushion in situation the debtor defaults on the residential property and the funding requires to be sold to recuperate the funds.

Customers can also take advantage of a reduced loan-to-value ratio, as it might lead to far better loan terms, such as lower rate of interest or lowered fees (Alpine Credits Equity Loans). Comprehending the loan-to-value ratio is vital for both lenders and borrowers in the equity lending authorization process

Final Thought

To conclude, the certification process for an equity financing authorization is based upon essential qualification requirements, credit rating significance, debt-to-income proportion evaluation, residential or commercial property assessment needs, and recognizing loan-to-value proportion. Satisfying these requirements is critical for securing authorization for an equity funding. It is vital for customers to very carefully evaluate their financial standing and property worth to boost their chances of authorization. Comprehending these elements can assist people navigate the equity finance approval procedure much more properly.

Comprehending the interaction in between debt-to-income proportions, loan-to-value ratios, and other essential criteria is critical in securing approval for an equity car loan.Given the critical function of credit history ratings in identifying equity lending approval, an additional vital aspect that lending institutions evaluate is an applicant's debt-to-income ratio evaluation - Alpine Credits Home Equity Loans. Customers with a higher debt-to-income proportion might encounter difficulties in safeguarding approval for an equity financing, as it recommends a higher danger of defaulting on the lending. It is important for applicants to examine and possibly minimize their debt-to-income proportion before using for an equity funding to boost their opportunities of authorization

In conclusion, the credentials procedure for an equity finance approval is based on crucial eligibility criteria, credit scores score significance, debt-to-income ratio analysis, residential property evaluation requirements, and recognizing loan-to-value proportion.